Bad Credit Car Loans in Denver: Get Your Car Today!

Our bad credit car loans can help you get a car if you have a low FICO score.

In addition…

We’ll show you how to start rebuilding your financial stability.

For the most part…

We know bad things can happen.

It’s called life…

We get it.

And guess what?

We also know getting a car loan can be difficult when you have bad credit.

For this reason…

That’s why we specialize in helping you get back on a positive financial track by helping you get a car.

To begin with…

A score of 600 is usually needed to qualify for a conventional auto loan. However, keep in mind that the minimum scores can vary.

Before we go any further…

Let’s talk about a stress-free way to get your vehicle and save you time and money.

Contact one of our professional auto consultants to help you get your car.

You’ll love our service…

We’ll do all the work and get you the best vehicle, terms, and rates possible.

What’s more…

When you work with our auto consultants we save you time and money.

One of the benefits of working with our auto brokers is that we’ll shop the lenders for you.

With our programs, you don’t need to go from dealer to dealer hoping to get approved.

With our bad credit car loans program, we take the stress and hassle out of buying a car.

We make it easy and effortless.

Do You Need a Car but You’ve Been Turned Down?

Our Bad Credit Car Loans Can Help You Get Your Car…

Contact us at 303-761-8045 for more details and information.

16% of Americans are affected by bad credit.

You are not alone…

Don’t feel bad.

Low Credit Score… and You’re Wondering if Our Bad Credit Car Loans Program Could Help?

Yes. You’ve come to the right place.

Bad credit car loans are your answer.

What’s more…

We’ve been helping people with bad credit get their cars for over 20 years. JFR & Associates is home to over 40 professional auto consultants.

We have the best contacts in the financial and auto industry to ensure you get a top-quality vehicle with the most desirable terms and rates.

At JFR, we operate with respect and honesty.

People are always asking us…

What makes JFR different from a car dealer?

As your auto broker, we treat you like one of our family.

We manage the entire process of the sale, where a dealer only guides you with the vehicle selection and financing.

We work for you and do what’s best for you, your situation, and your budget.

Keep reading, and you’ll find out what makes us different and why our customers keep returning year after year.

First of all…

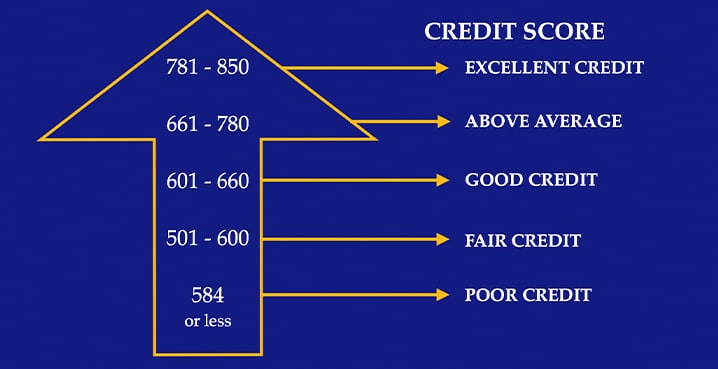

If you need a car, you’ll want to look at your credit score and see where you score. Credit scores range from 300 poor to 850 excellent.

Most important…

You’ll want to improve your FICO score because your credit affects every area of your life.

The following chart shows how your score is rated…

How To Get An Auto Loan With A Cosigner

Getting an auto loan when you have bad credit can seem impossible.

However, don’t give up.

Here are some options that may help you get your auto loan.

Obtaining an auto loan can be long and stressful, however we can help you through the process.

Tips for Getting a Bad Credit Car Loan…

Do you need a new car and financing?

These hot tips can help you get your car.

1. Avoid the ‘Buy Here, Pay Here’ Deals

You’ll be sorry if you purchase from these places.

You’ll typically find that these places have older and rougher vehicles. And they usually charge higher processing fees and higher interest.

They also charge more than a regular dealer and tack on excessive prepayment penalties if you want to pay the vehicle off early.

2. If Possible, Put More Money Down (I know this isn’t easy.)

But look at it this way…

Putting more money down shows the lenders that you’re serious.

Besides, putting money down can reduce your monthly payment.

3. Look at Less-Expensive Vehicles

The bottom line is this…

Because you’re dealing with a higher interest rate, you should look at a cheaper car.

That way, you don’t have to borrow as much money, and you can keep your monthly payment lower.

But, once you improve your credit score, you can always trade this vehicle in or refinance it.

4. Find a Cosigner

Find someone who will cosign on your loan to help you reestablish your credit.

Remember that your cosigner handles payments if you don’t make them.

5. Refinance Your Car Later

On the positive side…

Because you’re paying higher interest on your loan right now doesn’t mean you’re stuck with this loan for the entire term.

The good news is…

You can refinance your loan usually after making payments for at least 12 months or more and improving your credit score.

Here’s the point…

When you get ready to refinance, contact us and we’ll take care of it for you.

How to Understand Your FICO Score to Help You Qualify for Our Bad Credit Car Loans

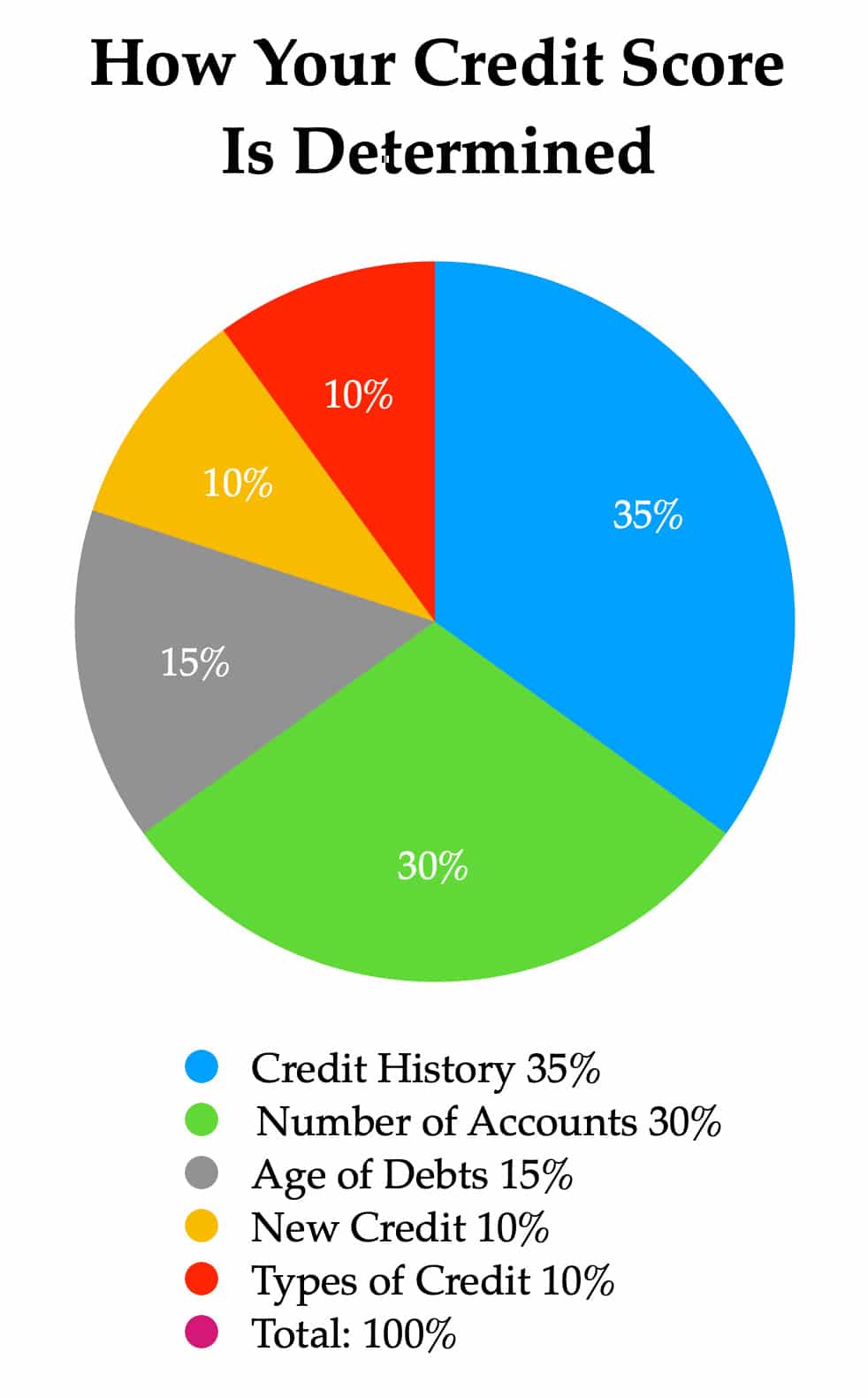

This chart represents your total FICO score.

The most significant percentage, 35%, is your credit history and how you make your payments.

Next is the number of accounts and balances; this makes up 30% of your total score.

The next part of the pie is 15%, representing your accounts’ ages.

New credit and balances appear in the next 10% of the pie chart.

The last 10% represents your accounts, like mortgages, car loans, credit card balances, etc.

Lenders like to see different types of accounts.

How Your Credit Score is Calculated

Your credit history 35%, explains your payment history so a lender can make a decision to approve or reject your loan.

When you make your payments on time it helps to raise your FICO score.

What’s more…

By making a late payment your FICO score can take a hit by lowering your score by 80 to 120 points.

Late payments stay on your credit report for seven years.

The credit bureaus are looking for frequency and patterns of late payments to determine your credit history.

This Can Improve Your Score!

To begin with…

What I’m about to share with you is the most significant factor in helping to raise your credit score.

Make Your Payments on Time!

When looking at your financial picture, lenders review how many open accounts you have and your balances.

Lenders look to see how much you owe by comparing your earnings against your spending habits. This is also known as your income-to-debt ratio.

Avoid Too Much Debt

Keep your debt-to-income ratios in balance.

This portion of your credit score helps credit bureaus determine whether or not you are over-extending yourself.

Lenders like to see 36% or less debt load for most people.

FAQ: Our Customers Want to Know…

Can you get a car loan with horrible credit?

Yes, even with horrible credit, like between 500 and 600, you can get a car loan. Poor credit can make it more challenging to get approved for a car loan, but it’s not impossible.

Although having bad credit may worry you about getting approved for a car… don’t give up.

Contact us today. We have lenders that can help you with bad credit loans.

What's the lowest credit score you can get a car loan with?

There isn’t any minimum score when considering buying a car.

But a higher score gives you better chances for approval and better rates and terms.

Can I get approved for a car loan with a 500 credit score?

Yes, you can. Buying a car is doable if your score ranges between 500 and 600.

With a lower score, lenders will charge a higher interest rate and fees.

So it’s always in your best interest to have a higher score.

Three Tips to Building a Strong Credit Rating

In summary…

You can begin doing three things this month to help improve your credit score.

1. Keep Your Credit Account Balances Low.

2. Pay Off Your Debts.

3. Build a Good Payment History.

And don’t forget the number one thing you want to do monthly…

Make Your Payments on Time!

Here’s the deal…

Your Credit Score Matters…

And do you know why?

Because your FICO score stays with you for your entire lifetime.

Your credit score impacts every area of your life.

Here’s the kicker…

This little three-digit number helps lenders determine if they should approve or reject your mortgage, auto loan, or credit cards and how much to charge you for interest.

The interest you pay can make the debt more or less expensive. However, your FICO score also impacts your insurance, cable services, checking and savings accounts, utilities, employment, and cell phone bill.

It also impacts your ability to buy or lease a vehicle.

Landlords and property managers use your credit score to determine where you’ll live.

And many people use your credit score to evaluate you as a person.

Next…

We’re going to look at how you can…

Discover your benefits with our service and Bad Credit Car Loans program.

After all of this…

You might be wondering how this will work for you.

That’s a good questions…

We created this program so you can get your life back and start rebuilding your financial stability.

Now you can have the car you want and need… without having all the stress and hassle.

And don’t overlook the fact that…

We don’t use any high-pressure sales tactics of any kind… so you can relax and know you’re in an environment with only your best interest in mind.

How do you get your car with our program?

Simple.

Try it…

For more information or questions, call us at 303-761-8045 today.

P.S. So what does all this mean?

To begin with, let’s recap the essential topics here today.

We talked about…

1. How our bad credit car loans program can help you get your car, even with bad credit.

2. We’ll do all the work for you so you can relax and enjoy the process.

3. Why your credit score is so important and the impact it has on your life. And how you can raise your score.

On the positive side…

Our system works and can get you the car you want and need.

So, what are you waiting for?

You’ve got nothing to lose.

Contact us today: 303-761-8045.